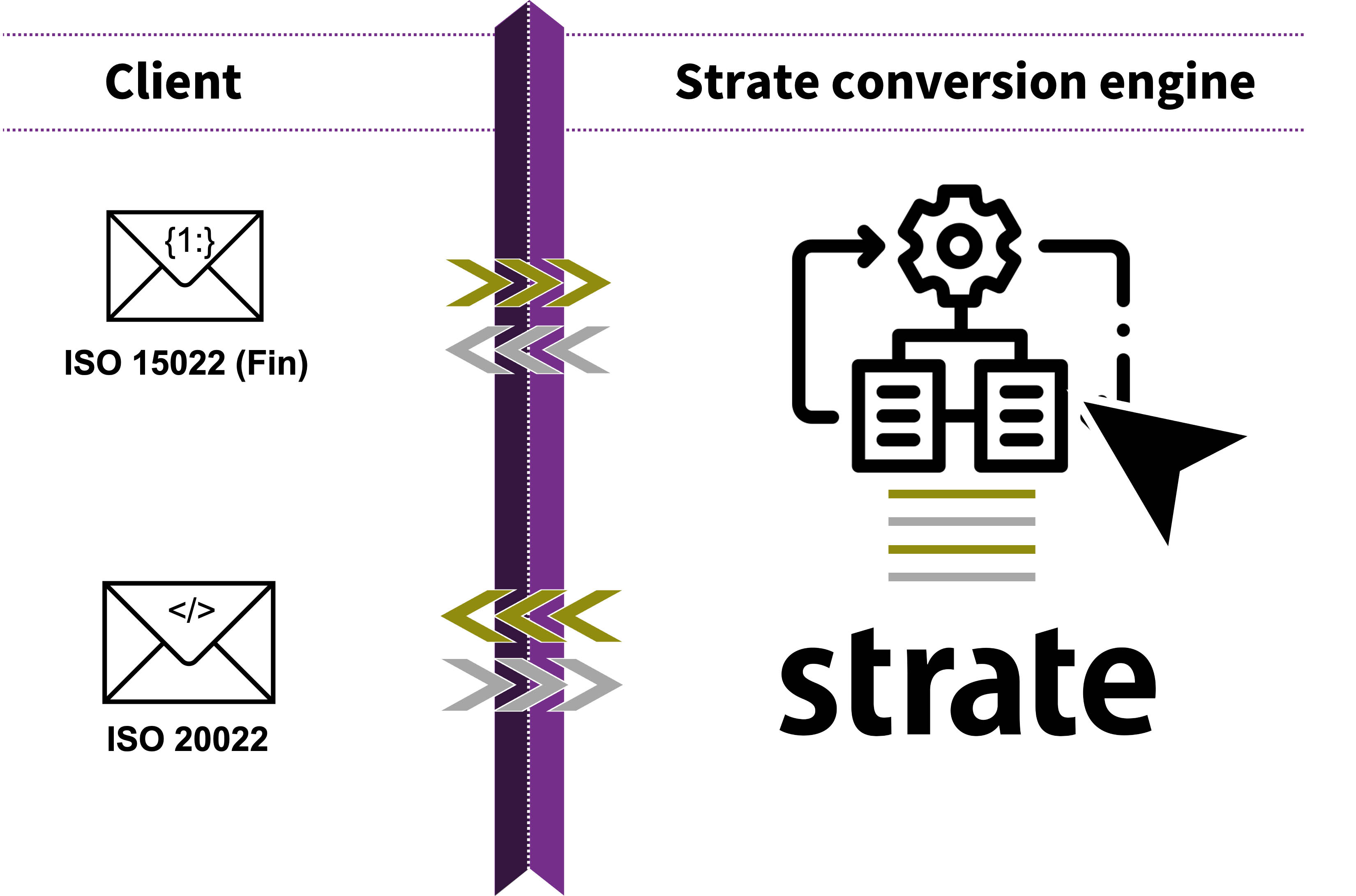

The South African Reserve Bank is working with the payment industry to replace the existing Real-Time Gross Settlement (RTGS) system with a new-generation ISO 20022 solution that will cater to requirements stemming from payment innovations, regulatory changes and the evolving business landscape.

Future communication with payment systems will require instruction in ISO 20022 format. ISO 20022 is an increasingly established global language for payments messaging that is already used by payment systems in over 70 countries.

It will become the standard for high-value payment systems of all reserve currencies, supporting 80% of global volumes and 87% of the value of transactions worldwide. SWIFT will enable ISO 20022 messages for cross-border payments and cash reporting businesses starting from the end of 2022.

Independent Non-executive Director

BSc Mathematics and Applied Mathematics (Honours), MSc Applied Mathematics (cum laude)(SU), CFA charter holder

Helena is former CEO of Satrix, the leading provider of index-tracking products in South Africa, wholly owned by the Sanlam Group. Since joining Sanlam Investments in 2000, Helena has built up a highly regarded indexation business, which has over R140 billion in assets under management. Her team also manages the largest equity portfolio of Exchange Traded Funds (ETFs) in South Africa. Under her strategic leadership, Satrix has built up a formidable offering of both vanilla, factor and global products, which are available in the retail and institutional markets across ETF, unit trust and segregated portfolios.

Independent Non-executive Director

BSc Mathematics and Applied Mathematics (Honours), MSc Applied Mathematics (cum laude)(SU), CFA charter holder

Helena is former CEO of Satrix, the leading provider of index-tracking products in South Africa, wholly owned by the Sanlam Group. Since joining Sanlam Investments in 2000, Helena has built up a highly regarded indexation business, which has over R140 billion in assets under management. Her team also manages the largest equity portfolio of Exchange Traded Funds (ETFs) in South Africa. Under her strategic leadership, Satrix has built up a formidable offering of both vanilla, factor and global products, which are available in the retail and institutional markets across ETF, unit trust and segregated portfolios

Independent Non-executive Director

BSc Mathematics and Applied Mathematics (Honours), MSc Applied Mathematics (cum laude)(SU), CFA charter holder

Helena is former CEO of Satrix, the leading provider of index-tracking products in South Africa, wholly owned by the Sanlam Group. Since joining Sanlam Investments in 2000, Helena has built up a highly regarded indexation business, which has over R140 billion in assets under management. Her team also manages the largest equity portfolio of Exchange Traded Funds (ETFs) in South Africa. Under her strategic leadership, Satrix has built up a formidable offering of both vanilla, factor and global products, which are available in the retail and institutional markets across ETF, unit trust and segregated portfolios

Chief Financial Officer

BCom (Hons) Accounting (UKZN), MCom Accounting (Wits), CA(SA)

Sameera Dada is Strate’s Chief Financial Officer. Previously, she held the position of chief risk officer at Ashburton Investments. Prior to that she held numerous roles including heading risk management at MMI Investments and Savings and serving as a financial and investment risk manager at Momentum Asset Management.

Sameera Dada is Strate’s Chief Financial Officer. Previously, she held the position of chief risk officer at Ashburton Investments. Prior to that she held numerous roles including heading risk management at MMI Investments and Savings and serving as a financial and investment risk manager at Momentum Asset Management.

Gregory Naicker is Head of CSD Services. He has built up a career of over 20 years at Strate and has substantial institutional knowledge of the business, stakeholders and the markets, both in South Africa and internationally. His passion for Strate has led him to build credibility with internal and external stakeholders across the market.

Farzana Khan is Head of Collateral Services. She most recently headed Rand Merchant Bank’s securities lending division and has over 22 years’ experience in the financial sector. Prior to Rand Merchant Bank, she held posts at Merrill Lynch S.A. and Standard Corporate & Merchant Bank. She is a registered securities trader with the JSE Securities Exchange, holds the designation for the Settlement Officer’s Exam and has the International Capital Markets Qualification from the South African Institute of Financial Markets.

Rudi Steenkamp is Head of Technology and Data Management. He oversees the entire IT function of Strate. Since joining the company through Strate’s merger with UNEXcor in 2003, Rudi has worked in the IT space for over 16 years. With one of the most advanced and sophisticated IT infrastructures for a CSD, Strate has achieved 99.995% uptime for the last four years and is one of the top 2% users of the SWIFT Network internationally.

Beverley Furman is Head of Operations. Previously, she was the Head of Strate Supervision, which she created in 2001 to supervise and monitor compliance by CSD Participants with South Africa’s securities legislation and the Financial Markets Act – a role Strate must perform as a licensed self-regulatory organisation. Bev has over 20 years’ experience in the financial markets.

Pheona Härtel is Head of Risk, Legal and Compliance. She is experienced in overseeing risk disciplines and has worked for several blue-chip financial organisations in South Africa where, among other things, she has led operational process re-engineering; implemented, and expanded upon, compliance and governance principles; championed Treating Customers Fairly objectives; and provided strategic risk and governance inputs to CEOs and executives.

Samantha Cooper is Head of Human Capital and Transformation. She has extensive experience in Human Capital Management. Samantha is a registered psychometrist and an accredited life coach. Before joining Strate, Samantha held a number of senior roles within the South African financial services sector.

Independent Non-executive Chairman

BCom (Hons), CA(SA), MBL (Unisa)

Nigel has a significant amount of experience in financial markets as well as in audit and risk management. He is a career non-executive chairman who serves on a number of boards including Mr Price Group Limited, Bid Corporation Limited and Vukile Property Fund Limited.

Chief Executive Officer

BCom (Hons) Financial Management (UP), MCom Finance (cum laude)(Unisa)

André Nortjé is Strate’s Chief Executive Officer. He has over 20 years of executive management experience across multiple financial services disciplines and across multiple jurisdictions with a deep understanding of financial markets from both the buy and sell side. Before joining Strate, André held numerous executive roles ranging from treasurer of a commercial bank to chief operating officer positions for several investment management businesses in South Africa and the United Kingdom.

André Nortjé is Strate’s Chief Executive Officer. He has over 20 years of executive management experience across multiple financial services disciplines and across multiple jurisdictions with a deep understanding of financial markets from both the buy and sell side. Before joining Strate, André held numerous executive roles ranging from treasurer of a commercial bank to chief operating officer positions for several investment management businesses in South Africa and the United Kingdom.

Chief Executive Officer

BCom (Hons) Financial Management (UP), MCom Finance (cum laude)(Unisa)

André Nortjé is Strate’s Chief Executive Officer. He has over 20 years of executive management experience across multiple financial services disciplines and across multiple jurisdictions with a deep understanding of financial markets from both the buy and sell side. Before joining Strate, André held numerous executive roles ranging from treasurer of a commercial bank to chief operating officer positions for several investment management businesses in South Africa and the United Kingdom.

Independent Non-executive Director

BASocSci (Swaziland), MSc Economic Policy & Analysis (Addis Ababa), Professional Certificates (Harvard)

Elias Masilela has held senior positions across multiple industries, including CEO of the PIC, head of policy analysis at Sanlam, deputy director general economic policy in the National Treasury, and director of research at the Central Bank of Swaziland. He currently serves as the Chairman of DNA Economics, Sanlam Limited and Impact Investing SA as well as commissioner of the 1st & 2nd National Planning Commission. He previously served on the boards of the South African Reserve Bank, the Government Employee Pension Fund, the Airports Company SA and the UN Global Compact Board. He also served as chairman of the UNGC SA Local Network.

He has written and published widely, enjoying nomination to the Top 40 of the Alan Paton Award, 2007. His most influential books are Number 43 Trelawney Park; KwaMagogo (2007) and Larry Simply Larry (2018).

Lead Independent Non-executive Director

BProc, LLM (UCT)

Keith Getz is a qualified lawyer with deep experience in takeovers and mergers, private equity, corporate restructuring, black economic empowerment transactions, exchange control regulations, commercial law contracts, regulatory compliance and stock exchange listings. In addition, he advises corporate clients nationally and internationally on corporate and commercial matters. Other directorships include Mr Price Group Limited and Spur Corporation Limited.

Independent Non-executive Director

BBusSc (UCT), BCom (Hons)(RAU), CA(SA), CD(SA)

Louisa is an independent financial trader and serves as an independent non-executive director of Multichoice Group, Royal Bafokeng Platinum, Tongaat Hulett and the Institute of Directors in South Africa.

She held a position as the uMnotho Fund Manager at the National Empowerment Fund, and as an investment banker at Rand Merchant Bank. Prior to that, she was General Manager of the Investment and Finance divisions of Nozala Investments and Chief Investment Officer of Circle Capital Ventures.

Louisa served her articles in KPMG’s financial services division.

Independent Non-executive Director

BCom (UL), PGDip (Financial Accounting)(UCT), BCom (Hons) (UND), PGDip (Auditing)(UCT), CA(SA)

Mathukana is a qualified Chartered Accountant (SA) with diverse work experience in corporate finance and financial management. Her working career includes, amongst others, employment by Standard Bank as a deal maker (Leveraged and Acquisition Finance), Cadiz Financial Services (Corporate Financier) and Woolworths (Financial Analyst).

Mathukana serves on multiple boards, including Sanlam Limited, Palabora Mining (Pty) Ltd, Stadio Holdings, Alviva Holdings and Contract Services Group Holdings.

Non-executive Director

BA (RAU), BA (Hons)(cum laude)(Unisa), MCom (UJ), PhD Economic and Financial Science (UJ), Graduate of Australian Institute of Company Directors (GAICD)

Leila Fourie is a seasoned business executive having previously served as an executive director of the JSE. Her career of more than 25 years spans the capital markets, payment systems, consulting, investment banking and retail banking. Leila has held multiple senior executive positions and directorships of global portfolios and served on both local and international boards.

Non-executive Director (alternate)

BCom (Wits), MBA (Gibs)

Rajesh is the Group Head of Standard Bank’s Investor Services business in sub–Saharan Africa where he has held several senior leadership roles, including head of business development, head of product management and head of cash management.

He has over 20 years’ experience in financial services in the areas of banking, securities services, FX and money markets and has worked for both domestic and international blue-chip firms.

Non-executive Director

B.Com (University of Natal)

Murray Stocks has wide securities and banking experience, having worked in multiple roles at Nedbank for over 30 years. His broad experience spans treasury, corporate and international banking, Society for Worldwide Interbank Financial Telecommunication (SWIFT), programme management, electronic banking, credit cards, cash and cheque operations, global trade and securities custodial services. Through his depth of experience, he is expert on settlement and CSD participant matters.

Non-executive Director (alternate)

BAcc (Wits), CA(SA)

Ryan Proudfoot has extensive experience across financial markets and products with specific expertise in trade execution, securities lending, futures clearing, prime broking, custody, market risk management, credit counterparty risk and regulation (including Basel III).

He has previously served as a director on numerous boards including RMB Stockbroking Operations (Pty) Limited and SAFCOM (Pty) Limited. Prior and current management board or memberships include the South African Institute of Stockbrokers, SAFCOM Derivatives Risk Committee, JSE Currency Derivatives Advisory Committee, ASISA’s Hedge Funds Standing Committee and JSE Bonds Advisory Committee.

Non-executive Director

BSc (Mathematics, Chemistry), PhD (Chemistry)(UCT)

Alicia Greenwood is the Director of Post Trade Services for JSE Limited, responsible for all clearing and settlement activities in equities, bonds and derivatives markets. Alicia is also the CEO of JSE Clear, the Central Counterparty (CCP) for the derivatives markets. Prior to joining the JSE in 2016, she spent ten years as a director of Standard Bank in various risk and capital management roles in corporate and investment banking. Alicia has also held roles at Discovery and Accenture, focusing on the development, and execution thereof, of financial services’ strategies.

Non-executive Director (alternate)

BSocSci Philosophy, PGDip Management (UCT)

Chris Edwards has been a managing principal at Absa for over 10 years where he also heads the Prime Services and Passive Funds businesses. He is also a director of Absa Stockbrokers. Prior to joining Absa, he spent 11 years with Morgan Stanley, based in London and then Hong Kong. During this time, he held a variety of positions, including responsibility for the distribution within the Prime Brokerage & Listed Derivatives businesses.

Independent Non-executive Director

BCom (Wits)

Mark Murning has extensive experience in financial markets, having worked in several roles across the investment banking, capital market and asset management businesses within the Sanlam Group.

Mark spent 26 years in the Sanlam Group, serving as the CEO of Sanlam Capital Markets, and subsequently as CEO of Sanlam Specialised Finance. He has held several positions, as a board member of divisional companies and on governance committee.

Independent Non-executive Director

MBA (Wits Business School) BCom (UKZN)

Kabelo Makwane has over 20 years’ information and communications technology experience and is currently Managing Executive for the Cloud, Hosting and Security enterprise business within Vodacom Business. Most recently, he was the Managing Director for the Africa Geo responsible for Accenture Operations, leading the Business Process and Infrastructure Outsource Business across Africa. At Accenture he also held the role of Managing Director for Cloud and Technology Consulting.

Kabelo has also worked at Microsoft, where his last role was Nigeria Country Managing Director. Prior to that he was at Cisco and Unisys Africa. Kabelo has fulfilled board responsibilities in the financial services and public sectors as a non-executive director and as part of independent advisory boards to the state.

Non-executive Director

BSc (Hons) Computer Science (Edinburgh, Scotland), Fellow (South African Institute of Financial Markets)

Stuart Yates held a long-established career in financial markets, having first joined the industry through specialised bond trading in 1979. He has held multiple roles in the financial sector including as the Banking Association’s member on the Bond Market Association and a member of the design team for SAFEX. After joining Rand Merchant Bank in 1992, he developed a treasury outsourcing business, headed HR during the FNB merger and was the bank’s representative on Strate’s board for six years. He is currently an independent non-executive director serving on a number of boards.

Strate Charity Shares

Strate Charity Shares (SCS) is an independent non-profit organisation, and joint market initiative from Strate, the JSE, ComputerShare and PSG who provide their services for free to realise the value locked up in odd lots of unwanted securities that could be used to support charitable causes.

It started with David Cobbett, a stockbroker, who had the idea of mobilising the millions of rands locked up in odd lots of shares in listed companies and using the funds for good causes. In 2001, he asked Tom Wixley, recently retired Ernst & Young chairman at the time, to help him make this dream a reality.

Market-wide engagement followed including with the Department of Social Welfare and the South African Revenue Service (SARS) who agreed that the value of any shares donated may be deducted from taxable income, as the scheme is registered under section 18A of the Income Tax Act.

Since its formation, Strate Charity Shares has given worthy causes over R10 million that would otherwise have remained unused.

To view the Strate Charity Shares funding and reporting guidelines, click here

Strate Charity Shares

Strate Charity Shares (SCS) is an independent non-profit organisation, and joint market initiative from Strate, the JSE, ComputerShare and PSG who provide their services for free to realise the value locked up in odd lots of unwanted securities that could be used to support charitable causes.

It started with David Cobbett, a stockbroker, who had the idea of mobilising the millions of rands locked up in odd lots of shares in listed companies and using the funds for good causes. In 2001, he asked Tom Wixley, recently retired Ernst & Young chairman at the time, to help him make this dream a reality.

Market-wide engagement followed including with the Department of Social Welfare and the South African Revenue Service (SARS) who agreed that the value of any shares donated may be deducted from taxable income, as the scheme is registered under section 18A of the Income Tax Act.

Since its formation, Strate Charity Shares has given over R10 million to worthy causes that would otherwise have remained unused.

To view the Strate Charity Shares funding and reporting guidelines, click here

Company Secretary

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.